VA Loan Benefits

:

Are you a veteran hoping to realize your dream of owning a home? If so, the VA loan might be your best choice. The VA loan program was developed in 1944 as a component of the GI Bill of Rights with the goal of giving veterans a special and advantageous chance to become homeowners. We will examine all facets of the VA loan in this thorough guide, from eligibility requirements to its many benefits, empowering you to make an informed choice regarding this fantastic opportunity.

Eligibility Requirements:

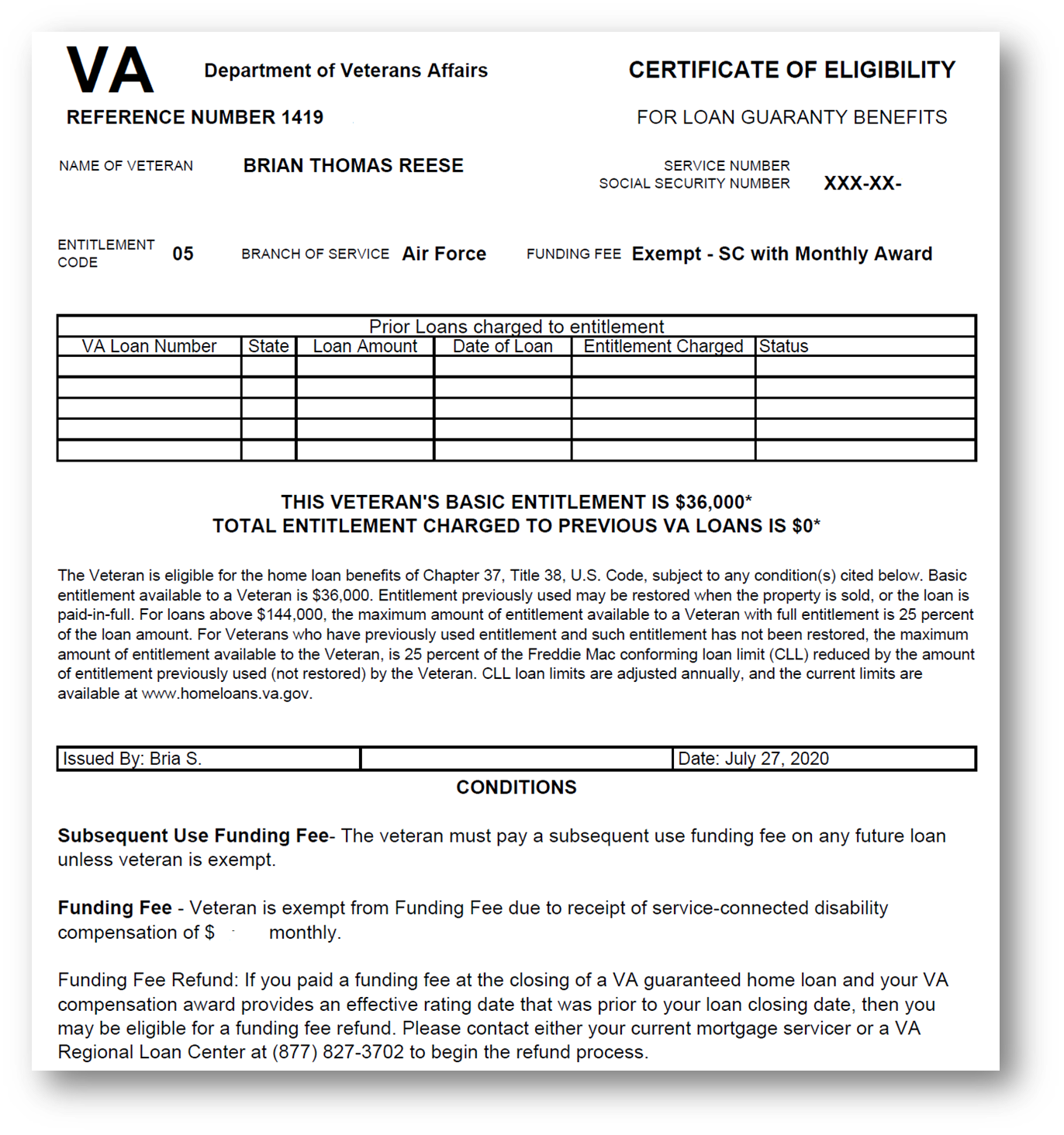

Veterans must first satisfy strict eligibility requirements in order to enjoy the advantages of the VA loan. It is necessary to have served a minimum of 90 days in a row on active duty during a conflict or 181 days in a peacetime. Veterans who have served in the National Guard or Reserves for at least six years are also qualified. You must get a Certificate of Eligibility (COE) from the Department of Veterans Affairs demonstrating your eligibility before continuing with the loan application.

No Down Payment Required:

The fact that most candidates for a VA loan are not required to make a down payment is one of its main benefits. Contrary to commercial loans, which may require substantial down payments of up to 20%, a VA loan enables qualified veterans to finance up to 100% of the value of their house. This provision not only lessens the financial strain but also gives veterans who might not have significant savings for a down payment the chance to become homeowners.

Funding Fee:

It’s important to remember that VA loans come with a funding fee, though. In the event of a default, this fee acts as an insurance premium to safeguard the lender. The funding fee’s amount varies depending on a number of variables, including your military service, any required down payment, and if this is your first time utilizing a VA loan benefit. Even with the funding charge, a VA loan typically has lower overall costs than conventional loans, especially when taking the lack of a down payment into account.

Competitive Interest Rates:

For veterans looking for reasonable mortgage terms, VA loans are a desirable alternative because they often have competitive interest rates. Similar to any other mortgage loan, these interest rates are impacted by the state of the market and the borrower’s creditworthiness.

Assumability:

VA loans’ assumability is one of its distinctive qualities. This implies that if you decide to sell your house in the future, a qualifying buyer can assume responsibility for the remaining payments under your current VA loan with the same interest rate and terms. If interest rates have increased since you initially obtained the loan, assumability may be a major selling factor.

Limited Closing Costs:

Veterans who use VA loans are limited in how much they can spend on closing costs, which helps ease their financial burden during the home-buying process. Additionally, veterans are permitted to bargain with vendors to pay a portion of these expenses, significantly easing the financial load on the purchaser.

Property Appraisal:

A property appraisal is necessary to determine the worth and condition of the property before a VA loan is finalized. The VA appraiser makes sure the property satisfies the MPRs set forth by the government. These conditions are in place to safeguard the veteran’s interests and guarantee that the home is safe and livable, but they are less stringent than those for conventional loans, giving homebuyers greater flexibility.

Loan Limitations and Entitlement:

The VA sets loan limitations based on the location of the property in order to minimize program misuse and preserve fiscal sustainability. The maximum amount the VA will guarantee for a certain loan is determined by these ceilings. However, it’s crucial to remember that there is no cap on how much a lender can offer as a VA loan. Borrowers who want loans over the VA’s set limits can still get them, but they might have to put down money to make up the difference.

Another crucial idea to comprehend is the eligibility for VA loans. Veterans who meet the requirements are eligible to a certain amount of money from the VA to cover their mortgage. The current basic entitlement is $36,000, however it’s vital to keep in mind that this is not the maximum loan amount. In some circumstances, the VA will even guarantee loans up to four times the minimum entitlement.

Foreclosure Avoidance and Loan Assistance:

Because of the unpredictability of life, financial challenges occasionally occur and make it difficult to make mortgage payments. Through numerous foreclosure avoidance alternatives, VA loans offer some level of protection to veterans in such circumstances. Veterans who are struggling financially might get help from the VA to look at alternatives to foreclosure, like loan modifications, repayment programs, or even more financial counseling.

Safeguards and Protections:

Numerous safeguards and protections are built into the VA loan program to guarantee that veterans are treated fairly at every step. When making and servicing VA loans, the VA expects lenders to conform to a set of rules and criteria.

Using the VA Loan Benefit Multiple Times:

Veterans can use their VA loan benefit more than once, contrary to popular assumption. Restoring their entitlement is the key. Either by selling the property and paying off the debt, or by paying off their current VA loan in full, veterans can regain their entitlement, releasing it for future usage.

Conclusion:

In conclusion, the VA loan is a crucial tool for veterans who want to realize their ambition of becoming homeowners. The VA loan program offers people who have served our country an appealing and reasonable financing alternative because to its flexible terms, low interest rates, and many benefits. Veterans can make informed decisions and start down the road to homeownership with confidence by being aware of the eligibility requirements, funding costs, financing, interest rates, and other components of the VA loan. The VA loan not only recognizes veterans’ service but also gives them the tools they need to secure a solid future for themselves and their families.

Utilize the VA loan program to take the first step toward homeownership and safeguard your future. Let’s talk!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link