Introduction

The process of buying a new home may be thrilling and intimidating in the world of Real Estate. It might be difficult to find a home that fits your needs and preferences, and the extra work of renovating it to your own taste can be even more difficult. Nevertheless, there is a solution that may take care of both property buying and renovation at the same time: the renovation loan. We will examine the many advantages of using a renovation loan to buy a property in this blog post, illuminating how this financial tool may make your goal of owning a customized home a reality.

Streamlined Process for Purchasing a Home

One of the biggest advantages of choosing a remodelling loan is the streamlined home acquisition process it offers. Instead of dealing with separate home purchase and renovation loans, borrowers can combine them into a single, cohesive package. This consolidated approach simplifies paperwork, saves time, and eliminates the hassle of managing multiple loans. With a renovation loan, homebuyers can effortlessly finance the purchase of their dream home and the required renovations, all in one seamless transaction.

Increased Affordability

Purchasing a property in its ideal condition might be out of reach for many buyers due to the high price tags associated with fully renovated homes. Renovation loans come to the rescue by providing homebuyers with an affordable path to homeownership. These loans permit borrowers to spread out the cost of renovations over time, easing the financial burden associated with major upgrades. This increased affordability allows prospective homeowners to invest in properties that have the potential to become their dream homes with some strategic enhancements.

Personalized Home Improvement with Renovation Loan

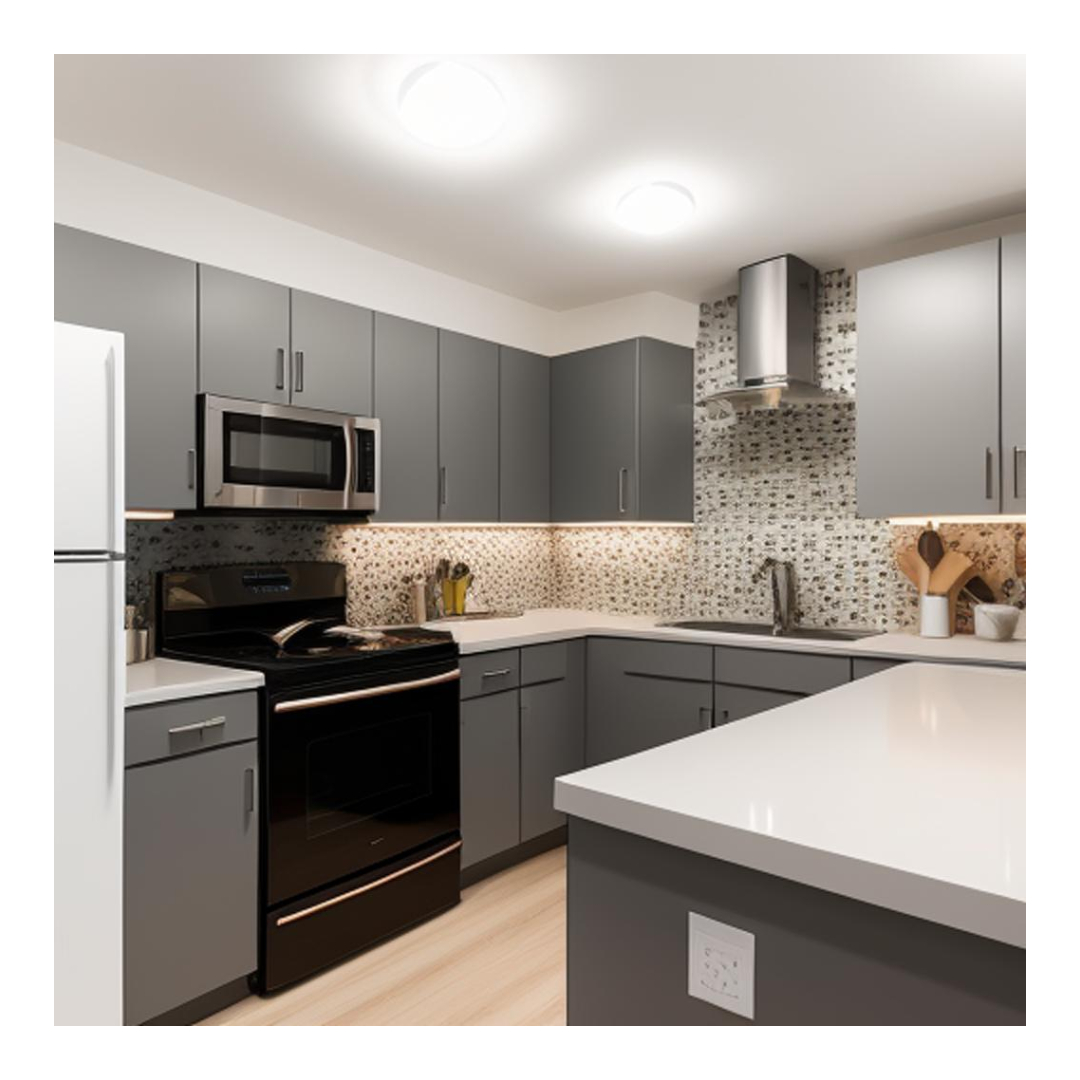

Every homeowner envisions a space that reflects their unique style and meets their specific lifestyle needs. Renovation loans make this possible by empowering buyers to customize their homes to their heart’s content. With the additional funding obtained through renovation loans, individuals can tailor their living spaces, transforming them into personalized oases. Whether it’s updating the kitchen, modernizing the bathroom, or adding a cozy backyard deck, the options are endless for creating a home that perfectly suits your taste.

Enhanced Property Value

Renovation loans not only cater to personal preferences but also serve as an investment in the property’s future value. By upgrading the home’s features and aesthetics, homeowners can potentially increase its resale value significantly. Renovations that boost curb appeal, energy efficiency, and overall functionality tend to attract buyers and yield higher returns. Hence, opting for a renovation loan is a strategic move that can lead to a substantial return on investment in the long run.

Access to Competitive Interest Rates

Unlike conventional loans, renovation loans often offer competitive interest rates, making them an attractive financing option. These loans are specifically designed to support property improvements, and lenders recognize that these upgrades can enhance the value of the property. As a result, borrowers may find themselves eligible for more favorable interest rates, which can translate to substantial savings over the loan’s term.

Overcoming the Challenge of Fixer-Uppers

Fixer-upper properties can be diamonds in the rough, brimming with untapped potential, but they also come with their own set of challenges. Renovation loans provide a viable solution for homebuyers eyeing fixer-uppers. With the financial backing to address necessary repairs and renovations, buyers can confidently take on the task of transforming a neglected property into a cozy sanctuary.

Accessible to a Wider Range of Buyers

One significant advantage of renovation loans is their accessibility to a wider range of buyers, including first-time homeowners and those with limited financial resources. Traditional loans often require high credit scores and substantial down payments, which can be a significant barrier to entry for some individuals. Renovation loans, on the other hand, may offer more lenient qualification criteria, making homeownership attainable for a broader demographic.

Avoiding Multiple Closing Costs

The process of purchasing a home and obtaining a separate renovation loan typically involves multiple closing costs. These costs can add up and put a strain on the buyer’s finances. However, utilizing a renovation loan for home purchase circumvents this issue. By combining both transactions into one, buyers can save on the expenses associated with multiple closings, making the process more cost-effective and straightforward.

Building Equity Quicker

Renovations carried out using a renovation loan can significantly increase a property’s value. As the value of the property rises, the homeowner’s equity in the home also grows. Building equity at a faster rate can provide homeowners with more significant financial security and flexibility in the future, enabling them to access home equity lines of credit or consider selling the property for a profit.

Conclusion

In conclusion, the use of a renovation loan to purchase a home brings with it a multitude of benefits that can revolutionize the homeownership experience. From simplifying the buying process to providing the means for personalized renovations, this financing option empowers individuals to turn houses into dream homes. By spreading renovation costs over time and potentially increasing property value, renovation loans offer an affordable and strategic approach to homeownership. Moreover, competitive interest rates and the ability to conquer the challenges of fixer-upper properties further enhance the appeal of renovation loans. Embracing this financial tool can be the key to unlocking a world of possibilities, allowing homeowners to not only realize their homeownership dreams but also to create spaces that truly feel like home.

Don’t miss out on the opportunity to learn more about renovation loans and how they can benefit you. Attend one of our upcoming workshops to get expert advice and guidance on navigating the renovation loan process, and take the first step towards making your dream home a reality.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link